Paul Krugman

March 5, 2010, 11:23 AM

Earlier this week I gave a talk about the state of the crisis at Princeton’s Plasma Physics Lab, and one audience member asked a really good question: if the problem is that interest rates are at the zero lower bound, why should we worry about government borrowing? After all, doesn’t that mean that the government can borrow at a zero rate?

Now, part of the answer is that you really don’t want governments financing themselves largely with very short-term debt — that makes them too vulnerable to liquidity crises. But even long-term rates are low — the real interest rate on 10-year bonds is below 1.5 percent.

And if you do the arithmetic of debt service, that really does seem to suggest that debt isn’t a problem. To stabilize the real value of debt, all the government has to do is pay the real interest on it. So suppose that we add debt equal to 100 percent of GDP, which is much more than currently projected; servicing that debt should cost only 1.4 percent of GDP, or 7 percent of federal spending. Why should that be intolerable?

And even that, you could argue, is too pessimistic. To stabilize the debt/GDP ratio, all you need is to pay r-g, where r is the real interest rate and g the economy’s real growth rate; and right now r-g looks, ahem, negative.

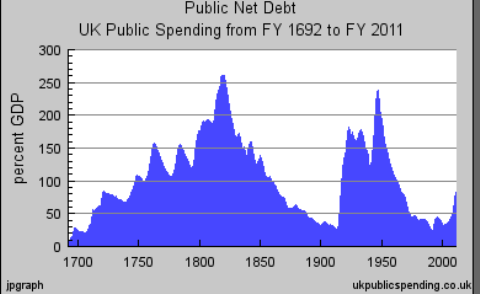

And this benign view of debt isn’t just hypothetical: countries have, in reality, run up immense debt/GDP ratios without going insolvent: see the history of Britain, above.

So what’s the problem? Confidence. If bond investors start to lose confidence in a country’s eventual willingness to run even the small primary surpluses needed to service a large debt, they’ll demand higher rates, which requires much larger primary surpluses, and you can go into a death spiral.

So what determines confidence? The actual level of debt has some influence — but it’s not as if there’s a red line, where you cross 90 or 100 percent of GDP and kablooie; see the chart above. Instead, it has a lot to do with the perceived responsibility of the political elite.

What this means is that if you’re worried about the US fiscal position, you should not be focused on this year’s deficit, let alone the 0.07% of GDP in unemployment benefits Bunning tried to stop. You should, instead, worry about when investors will lose confidence in a country where one party insists both that raising taxes is anathema and that trying to rein in Medicare spending means creating death panels.

http://krugman.blogs.nytimes.com/2010/03/05/debt-is-a-political-issue/

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου

Πρώτη προειδοποίηση!

Θα σας παρακαλούσα τα σχόλια να παραμένουν εντός θέματος.

Θα σας παρακαλούσα τα σχόλια να είναι ευπρεπή.

Αλλιώς θα αναγκαστώ να πάρω μέτρα.